The Sector Performance Identifier Grid serves as an essential analytical framework for evaluating industry performance. Each unique identifier, such as 120502055 and 659668330, provides insights into market trends and benchmarks. Stakeholders leverage this grid to refine their investment strategies and adapt to evolving market conditions. Understanding its implications can enhance decision-making processes, yet the mechanisms behind its effectiveness warrant further exploration. What specific strategies can be derived from this analytical tool?

Understanding the Sector Performance Identifier Grid

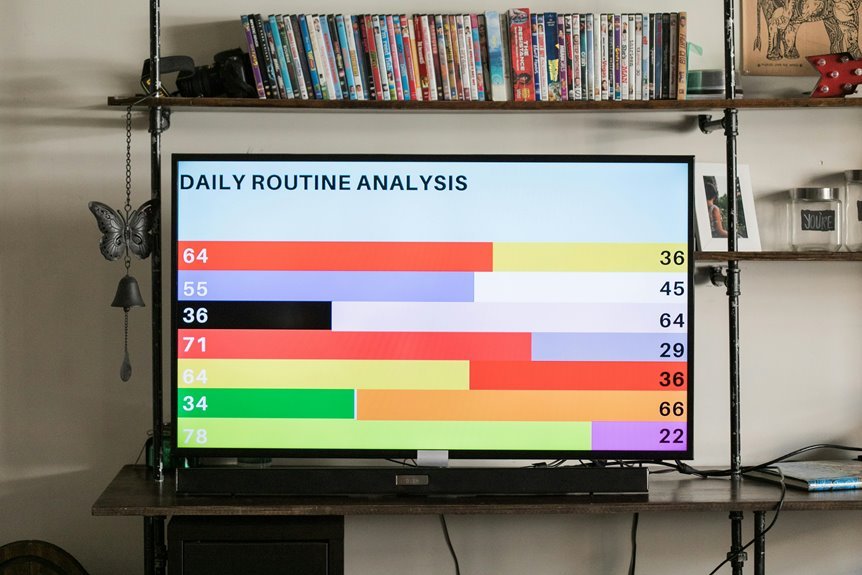

The Sector Performance Identifier Grid serves as a critical analytical tool for evaluating the performance of various industry sectors. Its effective grid interpretation allows analysts to discern trends and anomalies efficiently.

Identifier applications within the grid facilitate targeted assessments, empowering stakeholders to make informed decisions. By leveraging this structured framework, industry participants can enhance strategic planning and operational effectiveness, promoting a landscape of freedom and innovation.

The Significance of Unique Identifiers in Sector Analysis

Unique identifiers play a pivotal role in sector analysis by facilitating precise categorization and comparison among various industries.

Their identifier importance lies in enhancing analytical precision, allowing analysts to draw meaningful insights from vast data sets.

By employing unique identifiers, stakeholders can effectively benchmark performance across sectors, ensuring informed decision-making that aligns with their investment strategies and market expectations.

Ultimately, this fosters a sense of freedom in financial choices.

How to Utilize the Grid for Investment Strategies

While navigating the complexities of investment strategies, leveraging the Sector Performance Identifier Grid can provide investors with critical insights into sector-specific trends and performance metrics.

By analyzing these indicators, investors can develop effective investment diversification strategies and implement robust risk management techniques.

This data-driven approach empowers individuals to make informed decisions, optimizing their portfolios while maintaining the freedom to adapt to dynamic market conditions.

Real-Time Data and Its Impact on Sector Performance Evaluation

As real-time data becomes increasingly accessible, its influence on sector performance evaluation intensifies, allowing investors to make timely and informed decisions.

Real-time analytics enhances the understanding of performance metrics, enabling a more nuanced analysis of sector dynamics.

Consequently, stakeholders can swiftly adjust strategies, capitalize on emerging trends, and mitigate risks, ultimately fostering a more agile investment environment that aligns with their pursuit of financial freedom.

Conclusion

In conclusion, the Sector Performance Identifier Grid acts as a compass in the complex landscape of industry analysis, guiding investors through the shifting terrain of market dynamics. By leveraging unique identifiers, stakeholders can chart their course with precision, optimizing their strategies in pursuit of financial growth. Ultimately, the grid transforms raw data into actionable insights, illuminating pathways for innovation and investment, much like a lighthouse directing ships safely to harbor amidst turbulent waters.